Picture reveals An illustration of the pink egg in a blue nest with flying funds notes with dollar signs on them

Through transfer on the account of the employee underneath the NPS Scheme framed by the central authorities u/s 80CCD(two).

Review your employer's contributions, as well as your account costs, investment decision choices and coverage. in the event you’re not pleased or don’t understand any specifics about your fund, phone them and question thoughts.

Tremendous funds are subject to varied regulatory necessities to make certain they work in the most effective passions of their members. they have to adhere to expenditure rules, trustee obligations, and limits on withdrawals.

Calculator disclaimers and assumptions can be found less than Every single calculator. Refer to these for more specific details about how a selected calculator operates.

at times you will be in the position to Obtain your Tremendous early, like healthcare conditions or economic hardship.

So, all you must do is you undergo on your myGov account, you hyperlink the ATO, you simply click your superannuation accounts, and also you consolidate it into one particular. It is always that quick, Which gentleman was incredibly satisfied to know that it had been really easy to simply consolidate his 19 accounts.

search for increased employer contributions. Some Careers and sectors will provide a greater super contribution to staff as a reward or perk. a lot of government Employment present this.

Superannuation is a retirement fund supplied by an employer in Australia. You and your employer lead to this fund that can assist you Develop ample prosperity to fund your retirement.

Your superannuation is undoubtedly an investment decision portfolio inside your title that's managed for yourself by your super fund, and is particularly the most crucial technique for saving for retirement in Australia.

We stick to rigorous ethical journalism practices, which includes presenting unbiased information and facts and citing reliable, attributed methods.

The SG necessitates companies to contribute a proportion of the staff's earnings (at the moment set at 10.five%) into a brilliant fund. they're generally known as SG contributions, and they variety a significant Section of most of the people's superannuation.

April: Yeah, nicely, I basically had five individual superannuation accounts, Of course. And you are going to notify me later every one of the issues of doubtless consolidating, but it'd shock you to find out I basically experienced one person talk to me, or I helped them consolidate 19 superannuation accounts.

as compared to techniques like Social stability, superannuation combines defined-advantage and defined-contribution capabilities. Its origins might be traced again on the late nineteenth century, however it grew to become common Along with the introduction click here from the Superannuation assurance (SG) in 1992. The SG produced it necessary for companies to add to their staff members' super funds, guaranteeing retirement Advantages for almost all Australian workers.

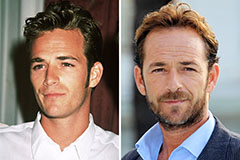

Luke Perry Then & Now!

Luke Perry Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!